Deliverable

History

Deliverable Draft Due Date: July

27th, 2007delivered July 30th 2007 due to delays.

Delivered to:

Ruth Skluzacek

Deb Shafer

Nancy Krukow

Deliverable Acceptance Date

Deliverable Accepted By:

Ruth Skluzacek_____

Deliverable Final Due Date: August

1st, 2007

Delivered to:

Ruth Skluzacek

Deb Shafer

Nancy Krukow

Deliverable Acceptance Date _______/_______/_________

Deliverable Accepted By:

Ruth Skluzacek

___________________ Date

Deb Shafer ___________________ Date

Nancy

Krukow___________________ Date

Table of Contents

1 System Features.. 5

1.1 Menus

and Screen Features. 5

1.2 Validation

Screens. 7

1.3 Standard

Button Selections. 8

1.4 IFTA

Transaction Flow and Navigation. 9

1.5 Inquiry

Features. 10

2 Enterprise Client.. 11

2.1 Creating

an Enterprise Client 12

2.2 Update

an Enterprise Client 15

2.3 Enterprise

Client Escrow Functionality. 18

2.3.1 Escrow, Prepay and

Bonds. 18

3 New Fleet.. 20

3.1 IFTA

Fleet Information. 21

3.1.1 Fleet Number 21

3.1.2 Client ID.. 21

3.1.3 Business (Licensee)

Name. 21

3.1.4 Taxpayer Identification

- TPID.. 21

3.1.5 Doing Business As. 22

3.1.6 Business Contact Name. 22

3.1.7 Fleet Effective Date. 22

3.1.8 Fleet Expiration Date. 22

3.1.9 Fleet Status. 22

3.1.10 Phone Number 22

3.1.11 Fax Number 22

3.1.12 Electronic Filer 22

3.1.13 Email Address. 22

3.1.14 Fleet Addresses. 23

3.1.15 Operation

Information. 23

3.1.16 Reporting Service. 23

3.1.17 Fleet Comments. 23

3.2 Billing

Information. 24

3.3 Payment 25

3.3.1 IFTA Payment Details. 25

3.3.2 Payment Collection. 26

3.4 Post

Payment 27

3.4.1 Thirty Day IFTA

Temporary Decals. 27

3.4.2 Issue Decals. 29

3.4.3 Shipping Document 29

3.4.4 IFTA License. 30

4 Renew IFTA Fleet.. 30

4.1 Renewal

Notice. 30

4.2 Renewal

Supplement 31

4.2.1 Fleet Information. 31

4.2.2 Billing Information. 33

4.2.3 Payment 34

4.2.4 Post Payment 34

5 Additional Decals.. 35

5.1 Billing

Information. 36

5.1.1 Payment 36

5.2 Post

Payment 36

5.2.1 Thirty Day IFTA

Temporary Decals. 36

5.2.2 Issue Decals. 37

5.2.3 Shipping Document 37

6 Change Fleet/Licensee Name Change.. 37

6.1 IFTA

Fleet Information. 38

6.2 Billing

Information. 40

6.3 Payment 40

6.4 Post

Payment Processing. 40

6.4.1 IFTA License. 40

This section provides an overview of elements that are

common among all transactions.

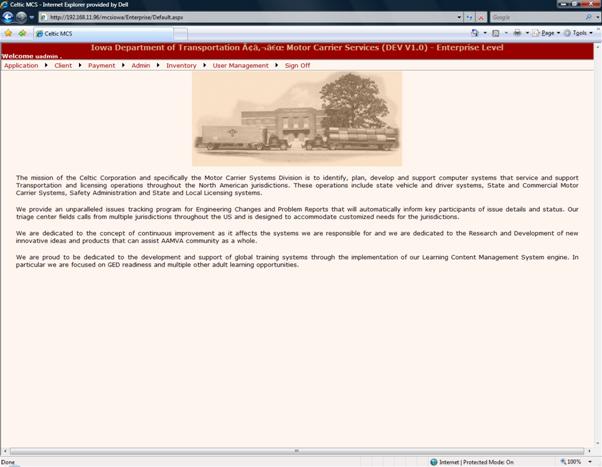

Currently there are two menus for

the MCS application:

- The Enterprise

level menu and

- The IFTA level menu.

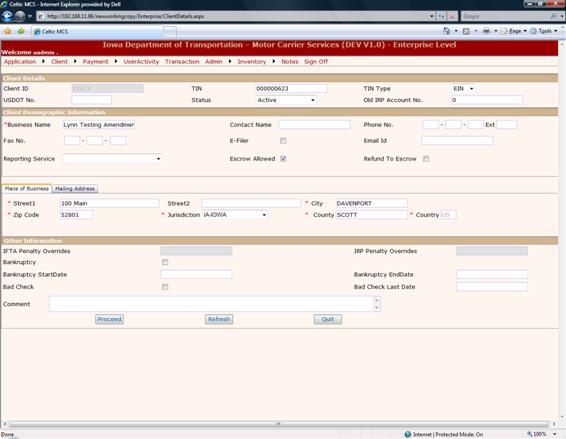

The Enterprise level menu functionality includes

all functions for the Enterprise Client and administrative functions for the system. The MCS Enterprise Menu will be displayed

when the user logs in to the system.

Enterprise Menu

Enterprise Menu features:

·

Page Header indicates which menu is currently

displayed.

·

Select “Sign Off” to exit the system

·

Select “Application – IFTA” and the IFTA Main Menu

will be displayed as follows:

IFTA Menu

IFTA Menu features:

·

Page Header indicates which menu is currently

displayed.

·

Select “Sign Off” to exit the system

·

Select “Enterprise”

and the user will be returned to the Enterprise Main Menu.

The Business Function beiong

performed is displayed along the top of each screen as shown:

After the user

finishes the data entry for a particular function, the system will present a

validation screen to provide the user with the opportunity to validate the information

before it is stored. The following

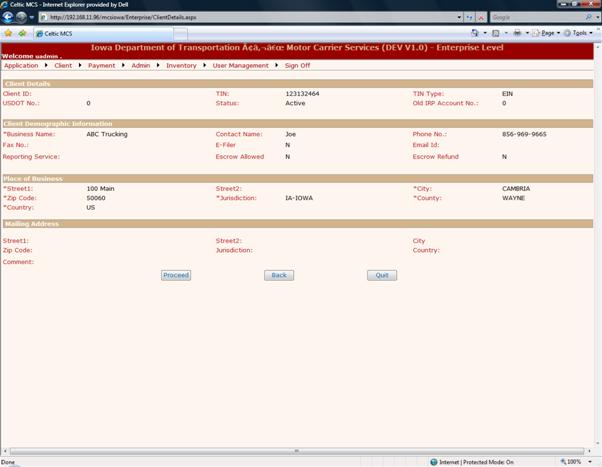

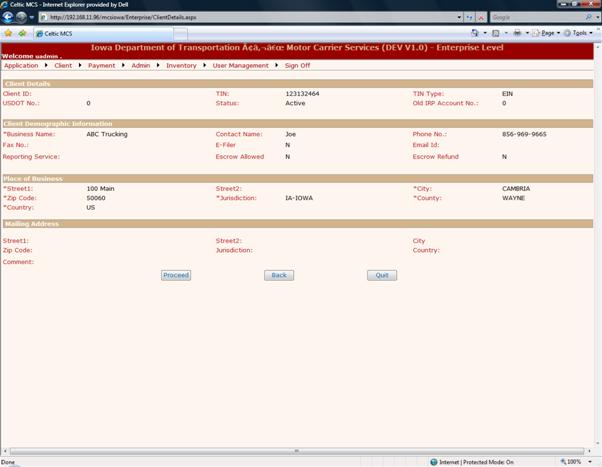

screen shows the validation screen for a New Client transaction.

The following functions

are available from the validation screens:

·

Select “Back” button to return to the data entry

screen and correct the information as needed.

·

Select “Proceed” button to continue navigation

to the next logical step of the transaction

·

Select “Quit” button to exit to the appropriate

menu. Current information on the screen

is not saved.

The MCS interface uses a set of

standard button selections through the business transaction. The following list provides the set of

standard selection and a brief description of their function:

Proceed

Continues transaction processing to

next step

Refresh

Restores all enterable values on the

screen to their original values

Quit

Exists to the

appropriate menu and does not save the information on the current screen. From inquiry pop-up, the quit will close the

pop-up

Back

Returns to previous screen

Cancel

Return to menu and

deletes (backs out) all information associated with the transaction

Help

Provide assistance regarding use of

the current screen

For Supplement and Tax Return processing, the business

transaction includes multiple screens.

The screens associated with these processes display tabs across the top

of the screen showing the user exactly what stage they are at in the

process. Fro example, the screen below

shows the user is at the Billing stage and that they have finished the Fleet

processing.

The user may return to the

previous tab screen by double clicking on that tab. If the supplement is in invoiced status or

the tax return has been calculated, the user will have to cancel the invoice before

they are allowed to return to any previous screen of information.

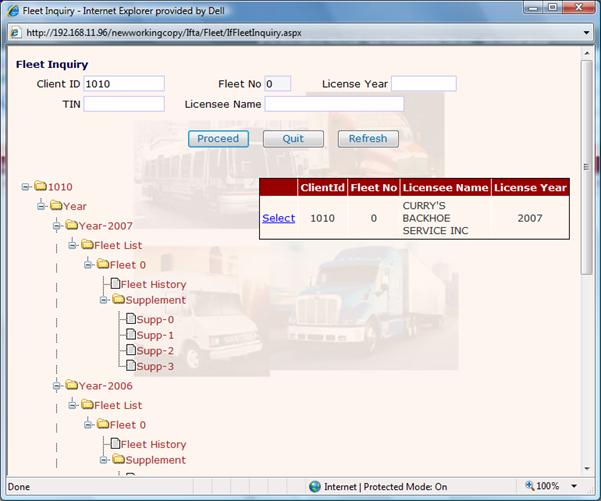

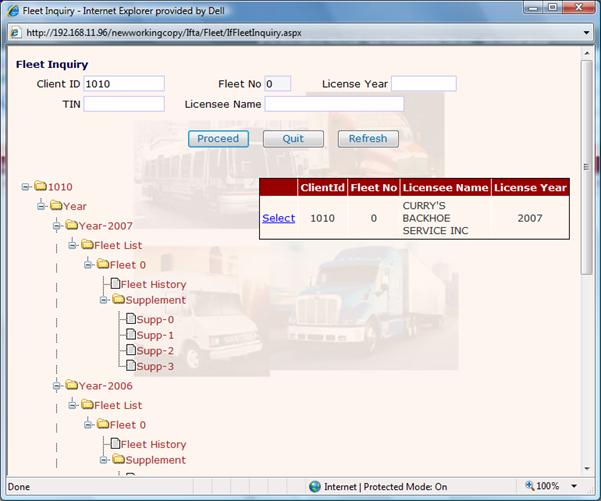

Selecting the Inquiry Function in the MCS system, the provide

the user with a pop-up inquiry screen.

Pop-ups must be enabled for inquiry to work. All inquiry screens have three sections:

1.

selection criteria,

selection criteria,

2.

selection list,

selection list,

3.

inquiry tree structure.

inquiry tree structure.

The user will enter

information into the selection criteria area and select “proceed”.

·

If multiple items are selected used the

selection criteria provided, a select list will be displayed

·

Select one item from the selection list by

clicking on the “blue” select option

·

After one item is selected, the inquiry tree

structure will be displayed

·

The user can expand and contract the inquiry

tree as needed

o Clicking

on the “-“ will contract

o Clicking

on the “+” will expand

·

Selecting “quit” from the Inquiry pop up will

close the pop-up screen

The MCS system has the following

inquiry functions by menu.

§

Enterprise

Menu Inquiry Options

o Enterprise Client

o Escrow

o Administrative Fee

o Inventory

o User

Management

·

IFTA Menu Inquiry Options

o IFTA

Fleet

o Tax

Return

o Tax

Rates

o Payment

o Supplement

o Payment

2

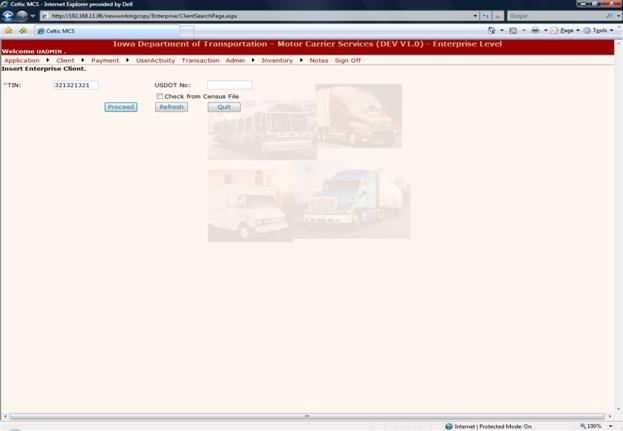

Enterprise Client

Before an IFTA fleet can be established,

the carrier must have an existing Enterprise Client. The Enterprise client

provides a common customer number and interface ensuring the MCS system will

provide cross system inquiries and edits between IRP and IFTA. The user will select the New Client Function

from the Client drop down menu item to create a new Client record.

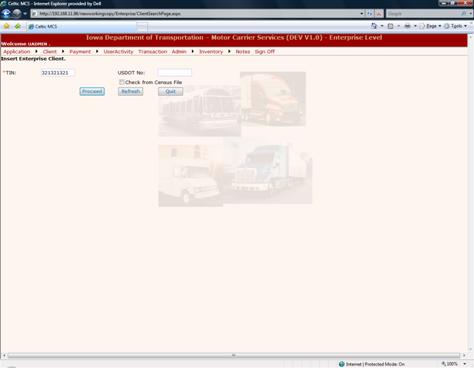

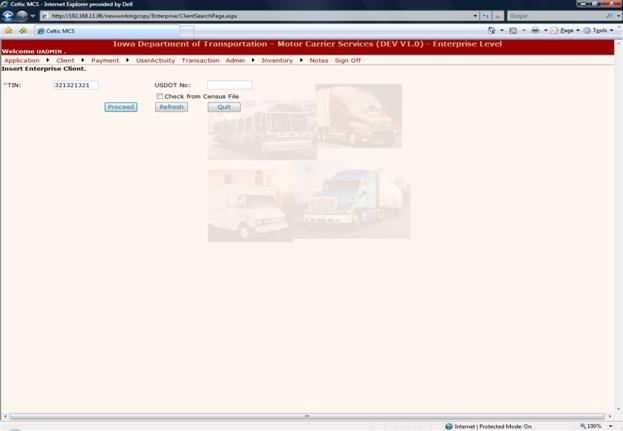

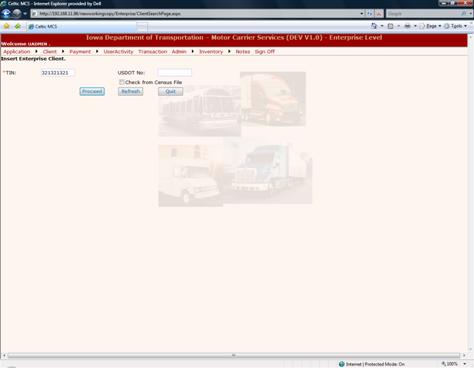

After selecting

the Create New Client function the “Insert Enterprise Client” Screen will be displayed

to gather some basic information about the Client including the FEIN/SSN and

USDOT if available. The user will select “Proceed” and the MCS system will

check for a duplicate carrier in the system and provide appropriate error

messages.

Once the

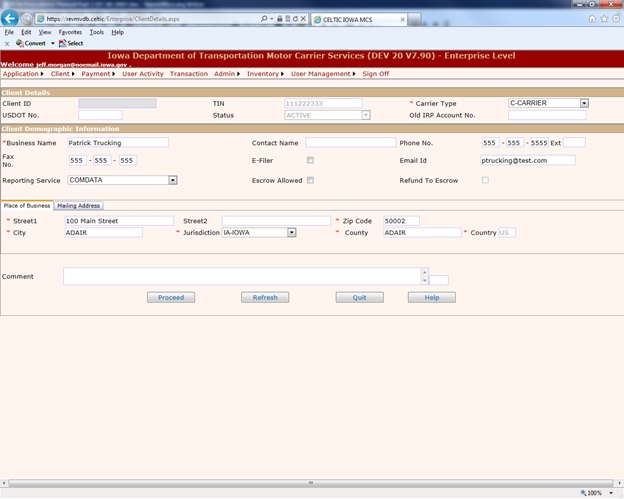

information is validated and the user selects “Proceed” the Enterprise Client

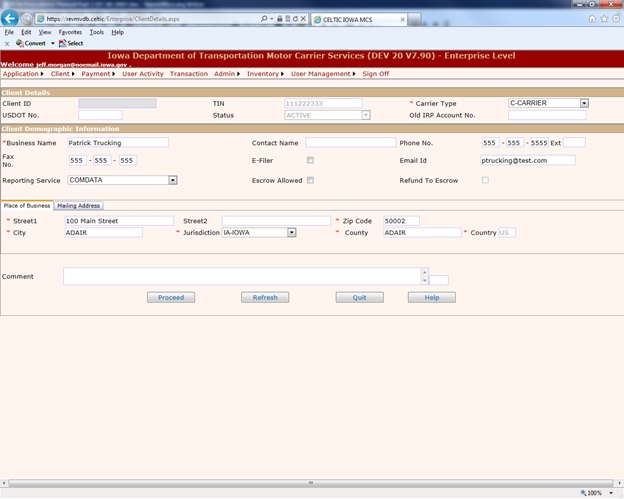

screen is displayed with the entered FEIN/SSN.

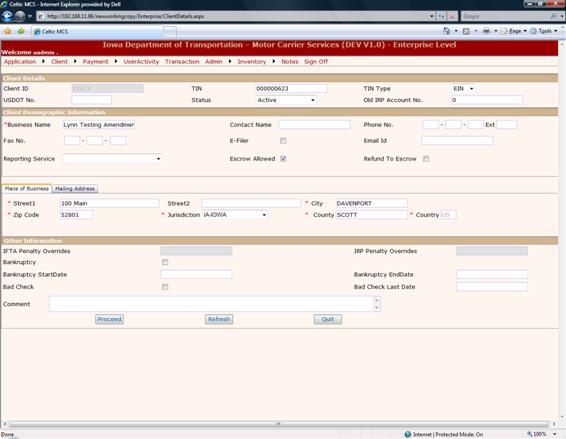

The user will enter/confirm the

following information:

·

Tax ID number (TIN) – Mandatory – TAX ID was

entered on the first screen and is not changeable during the Add process. The Tax

ID is for the IFTA fleet and IRP fleet(s) must be the same.

·

Tax ID type – either Federal Tax ID or SSN

·

USDOT number – Optional – if provided must be

unique number

·

Client Status – new clients will always have an

active status

·

Old IRP Account number – used for reference to

the legacy IRP system

·

Business name.

This is a mandatory and will be used by IFTA for the licensee name.

·

Business Contact name. This is an optional field

for the contact name for the business.

·

Business Phone number – optional – phone number

for the business

·

Business Fax number – optional – fax number for

the business

·

E-filer - An indicator if the carrier will

receive email and renewal notifications by email rather than through the mail.

·

Email Id - This is an optional field used to

store the email address for the business.

This field is mandatory if e-filer is checked.

·

Service provider ID – if the customer has a

service provider the appropriate id must be selected from the drop down. This information is used to determine who

will have access to the account for processing supplements and tax returns for

the carrier.

·

Escrow allowed Indicator - Iowa is allowing some carriers the ability

to have an escrow account. If this is

not allowed, the MCS application will not allow deposits into the escrow

account or refund posted to the escrow.

·

Refund to escrow Indicator - This indicates that

the carrier’s refund will go to an escrow account rather than the refund

process.

·

Place of Business address - Each carrier must

have a place of business address. The jurisdiction/state must be in Iowa, South Dakota, Minnesota, Missouri, or Nebraska. If state other than Iowa,

the user must select an Iowa

county from the drop down list. All

addresses will have street 1 address. If

the state of Iowa

is selected, the MCS will validate the zip, city and county combination.

·

Mailing address - The mailing address is

accessed by clicking on the tab. Mailing address is optional. If a mailing

address is not provided, the MCS system.

Mailing address can be in a state other than Iowa. If the state of Iowa is selected, the MCS system will

validate the zip and city.

·

Comments - The user can entered comments about

the Enterprise Client. These comments

are not updateable or viewable by the WEB users.

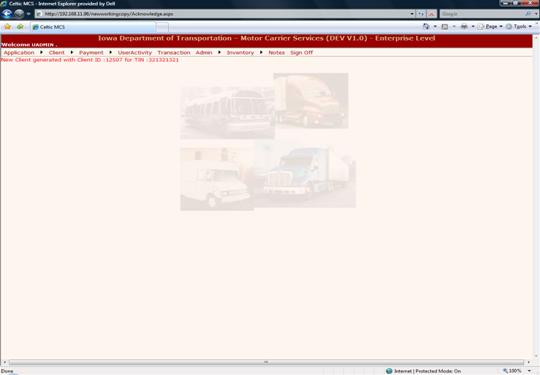

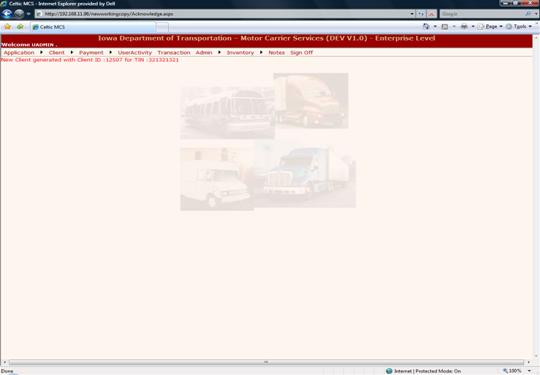

Once the mandatory

information is entered for the Client, the user will select “proceed”. The validation screen will display for the

users review.

From the

validation screen, the user can select “proceed” to finalize the creation of

the Enterprise

client.

If information

needs to be corrected, the user can select “back”, make the required changes

and proceed again.

Once “proceed”

is selected from the validation screen, the client information will be stored

and a message on the Enterprise

main Menu Screen will provide the new Client ID number.

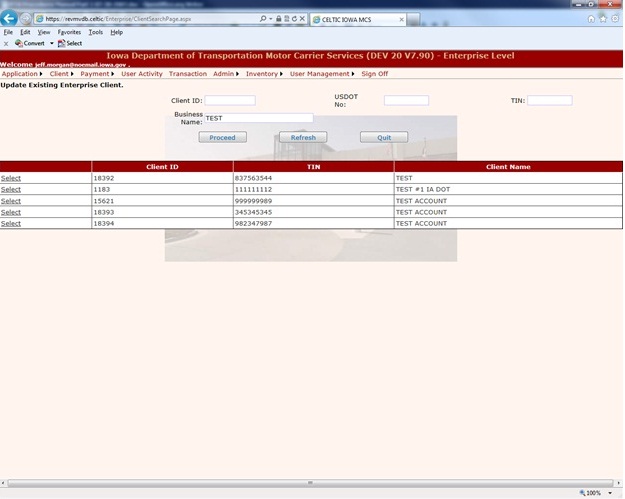

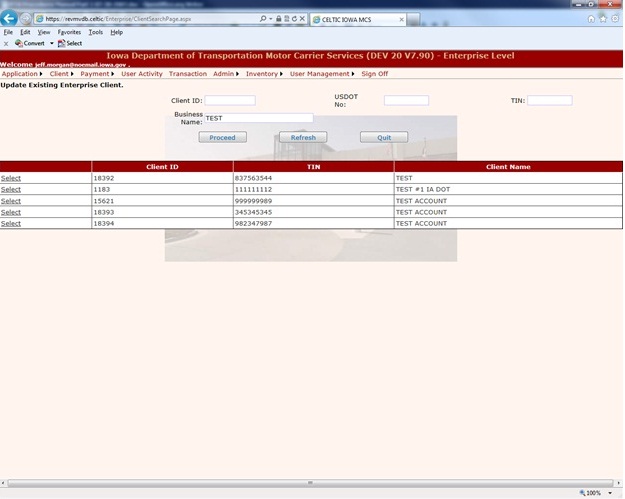

The user will select the Update

Client Function from the Client drop down menu item to update an existing

Client record and the Search Screen will be displayed. The user will providing any one of the

following fields on the search screen:

- Tax ID number,

- USDOT number,

- Business Name or

- Client ID

If the carrier

name is provided and more than one customer exists matching the name, a

selection list will be provided

When a specific

customer is selected for update, the user selects “proceed” to display the

client update screen with the existing client information pre-populated on the

Enterprise Client screen.

The user may

update the information as necessary.

Whenever any information is changed on the Enterprise Client, the

previous information history is kept.

The user can perform inquiries on history records using the Inquiry

function.

Changes to the Tax

ID and USDOT number will be validated to ensure that duplicate customers are

not created through the change process.

When information

is changed at the client level, it is important to note that changes will not necessarily

be automatically made at the IRP/IFTA level. The reason for this is that for

some types of field changes credentials must be reissued and fees may be charged. For these types of field changes the system

will utilize supplement processing to execute the changes. When the Tax ID or

business names are changed, the MCS system will generate a :Change Fleet”

supplement on the most recent IFTA fleet since a new license will be

required. The user can then proceed to

“Work in Progress” and finish processing the “Change Fleet” supplement to issue

a new IFTA license with the appropriate changes.

The procedure to

follow for Business name changes and Tax ID changes is as follows:

·

Change the information required on the

Enterprise Client

·

From the IFTA menu, select “Work in Progress –

Search Supplement”

·

Provide either the Client Id for the TIN and

select “proceed”

·

An open Change Fleet supplement will be in the

select list.

·

Select the open supplement and the MCS system

will display the billing screen.

·

If additional information such as address needs

to be changed at the fleet level, the user can proceed to the fleet screen by

clicking on the fleet tab at the top of the billing screen.

·

Upon completion of the supplement, a new license

will be provided in the format selected.

Two active

customers cannot have the same TIN.

Error messages will be provided and the TIN must be corrected to continue.

Additional

fields kept on the Enterprise Client that may be updated are:

·

IFTA penalty overrides.

§

The MCS system will store the year and quarter

of the last overridden penalty for easy reference by internal users. This field is only updateable by the system.

·

IRP penalty overrides.

§

The MCS system will store information about the

supplement and year of the last overridden penalty in IRP. This field is only

updateable by the system.

·

Bankruptcy information including start and end

date and an indicator if the carrier has come out from under bankruptcy

protection. These fields are updatable by the users and will affect the

suspension process for IFTA.

§

When a carrier files bankruptcy, they notify Iowa of the petition for

bankruptcy. The MCS system will provide

a date field for entry of the bankruptcy date.

This date can be changed if necessary either when the bankruptcy is

finalized or is dropped. For IFTA, the

bankruptcy indication affects processing of the non-filer and suspension

notices. Payments for the IFTA quarterly

tax return originals, amendments and audits can be accepted. Appeals will be

tracked on the IRP supplement or IFTA tax return quarter level.

·

Bad Check (NSF) indicators.

§

Some customers over time may have problems with

non-sufficient checks. The MCS system

will provide the ability to indicate at the Enterprise Client level that a

customer must pay all transactions with guaranteed funds. In the MCS system,

the Iowa

users will set this status on the Enterprise Client level and will be a manual

process.

§

There will be a batch job that will look at the

dates and remove the indicator when a year has passed since the bad check

date. At the discretion of Iowa management, the Bad

Check indicator may be set to indicate a “permanent” flag for carrier with

multiple offenses.

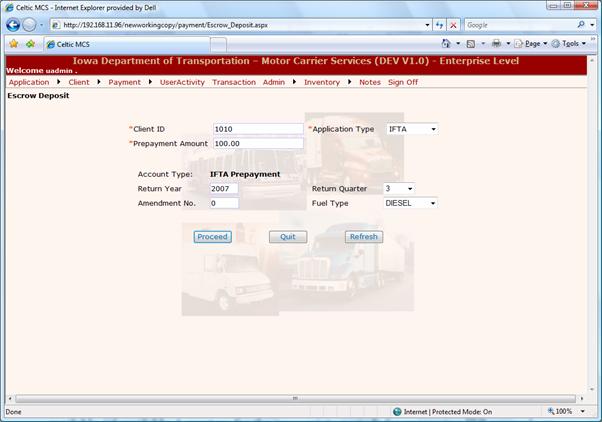

2.3

Enterprise Client Escrow Functionality

Additional functions at the

Enterprise Client include the ability to establish client escrow/credit. For the IFTA implementation there will be an

Enterprise Client escrow, IFTA prepayment, and IFTA Bond.

When a customer wants to deposit money into their account, the

MCS system provides a deposit mechanism to keep track of the money and make

sure it is used for the appropriate system transaction.

The MCS system has three major

sources of deposit:

- Escrow Deposit – This type of deposit is tied to the

client and can be used for the purpose of paying any transaction the user

wants to pay.

The procedures to

enter escrow are as follows:

·

Select “Payment – Escrow Deposit” from the Enterprise menu

o

Provide the Client ID

o

Provide the Deposit Amount

·

Select “Proceed” to display the validation

screen

o

Verify the information especially the licensee

name

·

Select “Proceed” to display the payment screen

o

Enter the payment information as required

- Prepayment Deposit– This type of deposit is tied to a

specific transaction (IRP supplement or IFTA QTR) and can only be used to

pay for that transaction. If this

prepayment amount is needed for something else, the user will transfer this

amount to the Escrow and then apply as necessary. Money cannot be retransferred from

Escrow into Pre-pay.

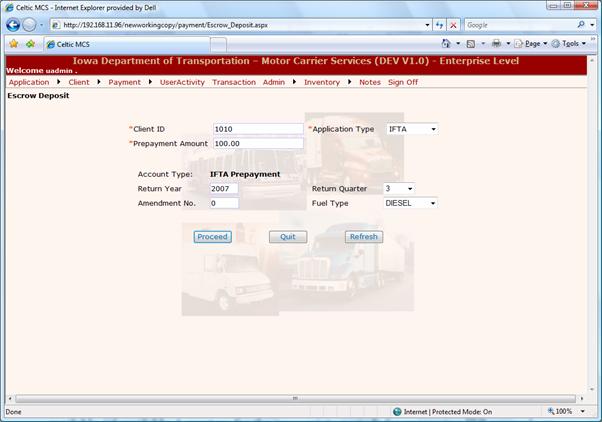

The procedures to

enter an IFTA prepayment are as follows:

·

Select “Payment – Escrow Deposit” from the Enterprise menu

·

Provide the following information:

o

Client ID

o

Application type – select IFTA

o

Prepayment amount

o

Return Year

o

Return Quarter

o

Amendment no – Original is zero

o

Fuel type

·

Select “Proceed” to display the validation

screen

o

Verify the information especially the licensee

name

·

Select “Proceed” to display the payment screen

- Cash

Bond – tied to the client and can be moved to escrow to pay for a

transaction. If there is any

remaining balance it will be refunded.

The bond information and status will be updated to reflect that it

was applied.

·

Select “Payment – IFTA Bond Deposit” from the Enterprise menu

o

Provide the Client ID

o

Provide the Deposit Amount

·

Select “Proceed” to display the validation

screen

o

Verify the information especially the licensee

name

·

Select “Proceed” to display the payment screen

o

Enter the payment information as required

These types of deposits will be reported in a Daily Receipt

– Escrow, Prepay, Bond report. It will

show an application ID on each line to show the type of deposit.

The consumption of these monies used to pay for transactions

will show on the Daily Ledger Report.

The Escrow column will reflect the amount used to pay for the

transaction but is not included in the deposit amount since it was already

deposited.

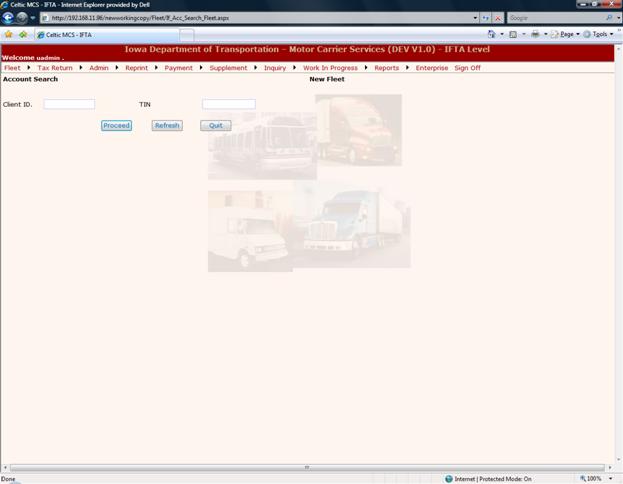

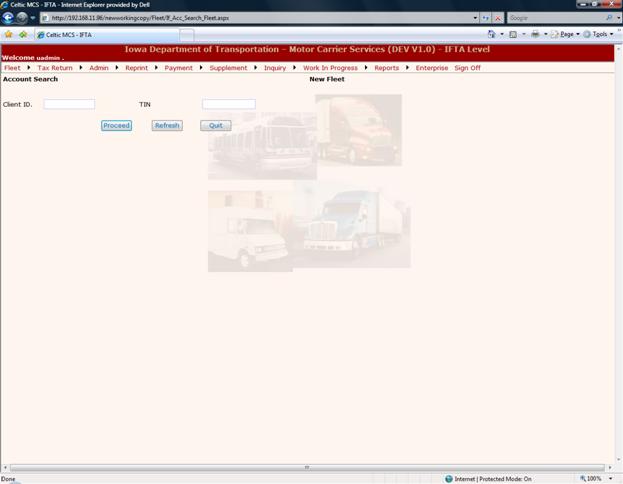

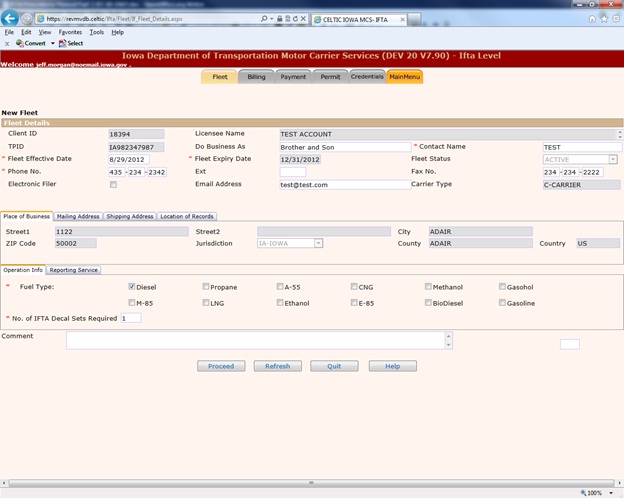

To create a new fleet, an Enterprise

client record must exist. To begin the

transaction, the user will select the New Fleet function from the IFTA Menu and

the Search screen will be displayed. The

user must provide the Client ID or Tax

ID and select Proceed..

If an Enterprise

client is not found matching the provided data, an error message will be

displayed. The user can check their information for correctness and take the

necessary action.

The Enterprise Client information will be searched on the provided

information, if an Enterprise

client is found the process will continue to the Create Fleet Screen.

A majority of the

IFTA fleet information will be brought forward from the Enterprise Client

profile and the user may update IFTA specific information as required.

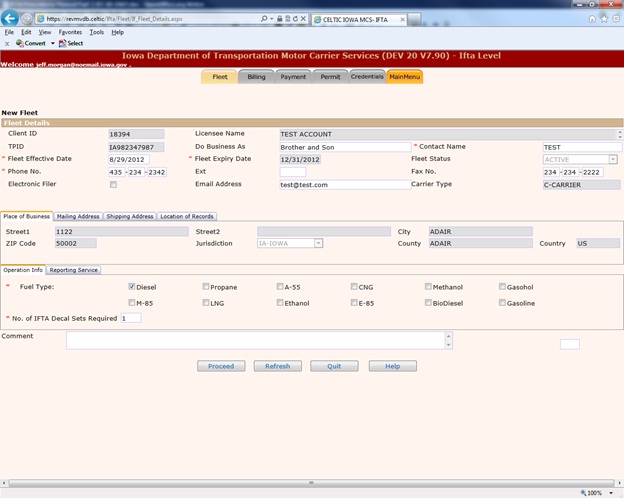

3.1.1

Fleet

Number

This is assigned by the system. Iowa

will have only one fleet and the fleet number will be zero and cannot be

changed.

The client id was assigned when the client was created and

cannot be changed.

This is the business name for the

carrier and it pre-populated from the Enterprise Client business name and

cannot be changed

The TPID is brought forward from the Client information

and cannot be changed.

The user can enter the DBA for the business if it is a

corporation. According to Iowa

business rules, the DBA name is printed on IFTA license and other documents or

correspondence with the carrier s name.

This field is mandatory for IFTA

and is pre-populated with the contact name from the Enterprise Client if

provided. The user may change the

contact name to the specified contact name for the given IFTA fleet.

IFTA licenses

must be renewed annually and are normally valid for the calendar year January 1

through December 31. For a new fleet,

the fleet effective date will default to today’s date and the user may change

as necessary

IFTA licenses must be renewed

annually and will expire on December 31 for any given year. This date will default to December 31 of the

current year. As the fleet effective

year changes, the fleet expiration year will be set to match the effective date

year.

The default

fleet status for the new fleet will be A – Active. For a complete listing of

all statuses refer to Fleet Maintenance section of this document.

This field is mandatory and is

the contact’s phone number. It is pre-populated from Enterprise Client, if

provided, and may be changed for the IFTA fleet. An extension may be provided

as necessary.

This field is not mandatory and

is the fax number for the IFTA Fleet. It

will be pre-populated from the Enterprise Client and can be updated as needed. This fax number will be used as the default

value when selecting to fax correspondence and credentials to the carrier.

Electronic Filer is a checked box

used to designate that a carrier would like to receive renewals and tax return

reminders electronically. If this boxed

is checked, the email address is required.

The email address for the contact

person or company address as requested by the carrier. This will be used as the default email

address when selecting to mail correspondence and credentials to the carrier.

The IFTA fleet can have up to four different addresses. The

place of business and mailing address will be pre-populated from the Enterprise

Client. The place of business address is mandatory and cannot be changed. The mailing address can be modified to a

specific mailing address for the IFTA fleet.

Each fleet can also have an optional decal shipping address and a

Location of Records Address.

3.1.15.1 Fuel

Types

The carrier must indicate all the fuel types for each fleet by

clicking the check box beside the applicable fuel types.

3.1.15.2 Number

of IFTA Decal Sets

The user must designate the

number of set of decals they will be require and are to be invoiced for.

The MCS system

will provide a listing of valid reporting service companies and an associated client

id. This information is entered on the Enterprise Client and will be

pre-populated from the Client level. The

user can change the reporting service and make it specific for the IFTA fleet.

To adding or

update reporting service information, the user clicks on the Reporting Service

Tab. The Reporting Service information is displayed including:

·

Name

·

Business Address

·

Phone Number

·

Fax Number

·

Email Address

A Power of

attorney document is required if the carrier is using someone other than an officer

or employee of the company to file quarterly tax returns. Once the Power of Attorney is provided by the

carrier, the user can click on the check box to indicate it has been received.

If the power of

attorney check box has not been checked and there is a reporting service, the

supplement transaction cannot continue.

The internal user can add any

comments associated with the IFTA fleet. WEB users cannot add or view comments.

When all the information has been entered the user will

click on the PROCEED button and the Validation Screen will be displayed. The user should select the “Proceed” button to

display the validation screen. Once the

information has been validated the user can select “Proceed” again to continue

to the IFTA Billing Details screen.

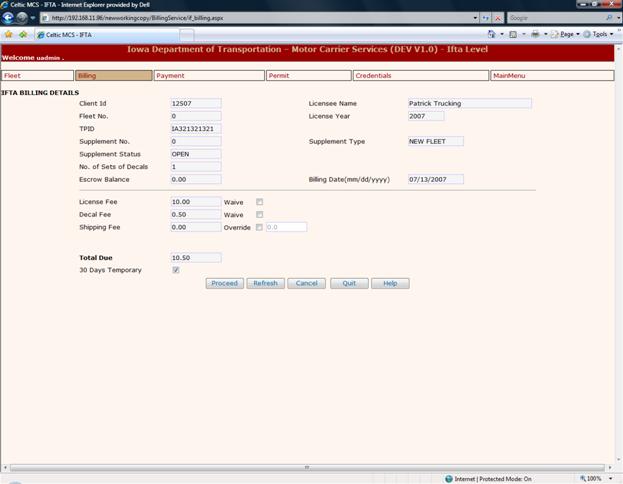

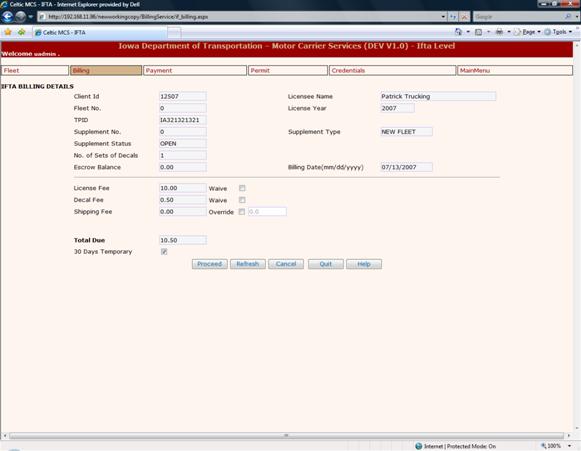

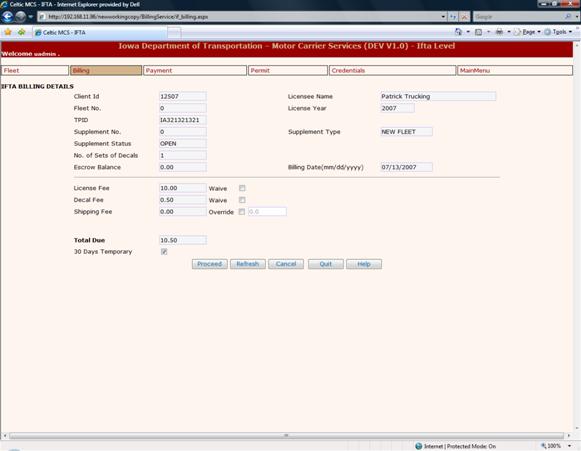

3.2

Billing

Information

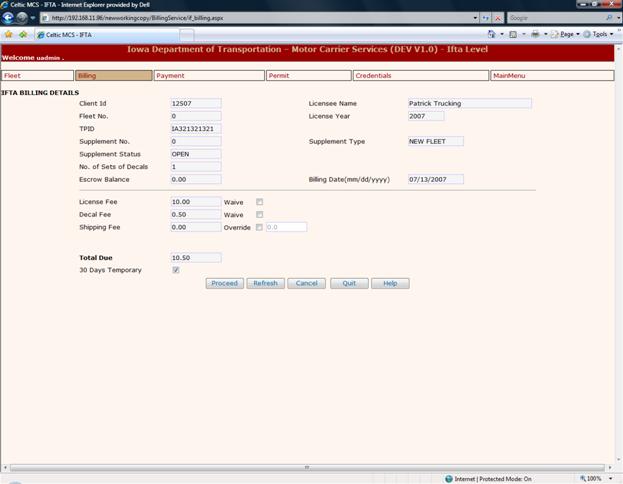

The billing screen shows the

billing information for the supplement but IFTA supplements do not require an

invoice to be generated.

Once the billing screen is

displayed the user has the ability to perform the following functions:

·

Click the Fleet Tab to go back to the Fleet

screen and update the information as long as the supplement status is “Open”

·

Override License and/or Decal fees by checking

the “Waive” check box beside the fee.

o License

Fee – the amount of the license (if any) - can be overridden (checkbox) - WEB

users cannot override any fees

o Decal

Fee – the amount of the decals – can be overridden (checkbox) - WEB users

cannot override any fees

·

Override the shipping fee (if any) by checking

the “Waive” check box and entering a new fee amount.

·

Request 30 day permits be selecting the “30 Day

Temporary” check box. The temporary

permits are not issued until after payment is collected.

·

Click the “Quit” button to exit the transaction

and continue later

·

Click the “Cancel” button to cancel the

transaction entirely

·

Click the “Proceed” button to Invoice the

Supplement and proceed to the payment initialization screen.

·

Cancel the bill if it is in “ invoice” status by

selecting the Cncel button.

After all the

information is entered at the billing screen, the user will select the Proceed

button and the IFTA Payment Details screen will be displayed.

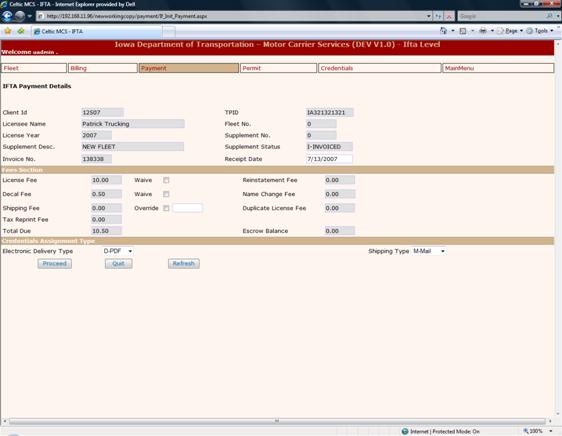

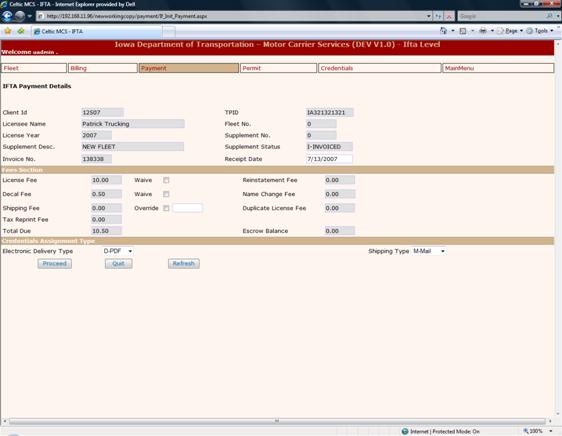

The payment

process consists of two screens: IFTA payment details and Payment Collection.

This screen

allows the user to perform the following functions:

- Return to the Billing screen by clicking on the

billing tab at the top of the screen

- Waive fees by selecting the check box beside the fee

- Change the receipt date of the payment – user enters

a different date

- Review the escrow balance for the customer – display

only

- Select the delivery method for the credentials by

selecting from the drop down. If

email or fax is selected, the user must provide an email or fax number

respectively. Credentials are provided after payment is made.

o The

shipping document must always be printed and will accompany any issued decals

when mailed to the carrier. The web

users will not have the ability to select print to an internal printer but they

can select “View” the PDF document and then save the documents to their local

hard drive or print to a local printer from the PDF display. When email is

selected the user must also provide the email address. The email address will be defaulted to the

fleet email address if provided.

Similarly, if the fax is selected, the fax number will be defaulted to

the fleet fax number if provided.

Selecting view will display the credentials and shipping document in a

PDF format.

o All

credentials and shipping document are provided after payment is made.

After all the

payment Details have bee entered the user will select the Proceed button and

the validation screen will be displayed. Selecting “proceed” from the

validation screen will proceed to the Payment Collection screen to collect the

type and amount of payment.

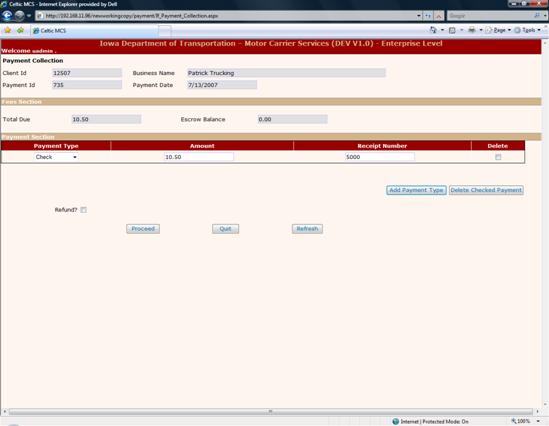

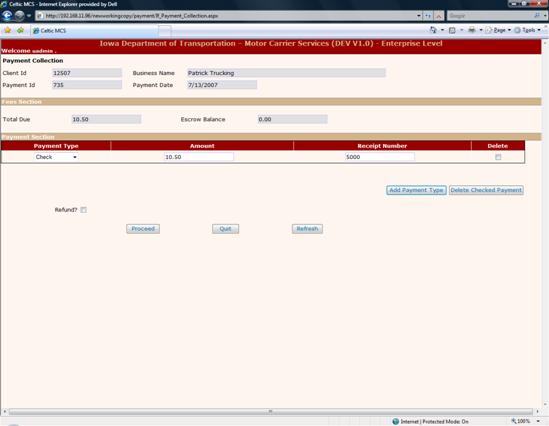

The Payment Collection

screen is where the actual payment is made in the MCS system. The user has the following functionality from

this screen:

·

Enter payment information:

o Select

payment type

§

Cash – requires a receipt number

§

Check – requires a check number

§

Wire transfer – requires a transfer number

§

Escrow funds - only displays if carrier has escrow funds

available

o Enter

amount

o Enter

the associated receipt number

·

Add payment types. User selects this when more

than one payment type is required for the transaction. For example, paying with multiple checks or

part cash and part check. Once this is selected another payment line will

appear and the user can enter the payment information.

·

Delete a selected payment method. To delete a

payment line, check the check the delete check box on the line(s) to be deleted

and press the “delete checked payment” push button.

After entering all the payment

information, the user will select “proceed” and the validation screen will be

displayed. If there are no errors the

user will select Proceed and the post payment processing will be invoked.

Once a

supplement has been paid for, the credentials for the given supplement can be issued. For a new fleet, the credentials issued

include the

- IFTA license,

- Decals, and

- Temporary authorities if requested.

Once the

credentials are issued, the supplement status will be updated to “C” indicating

Completed. The fleet information will be

reported to the Clearinghouse and detailed on the reports going to

non-Clearinghouse jurisdictions.

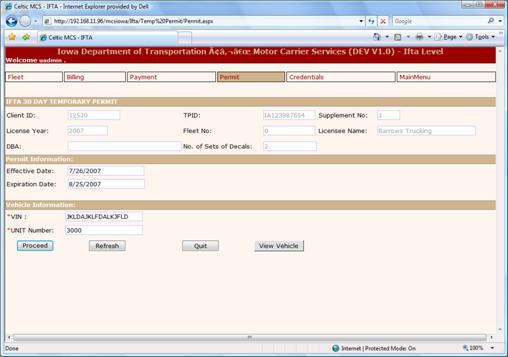

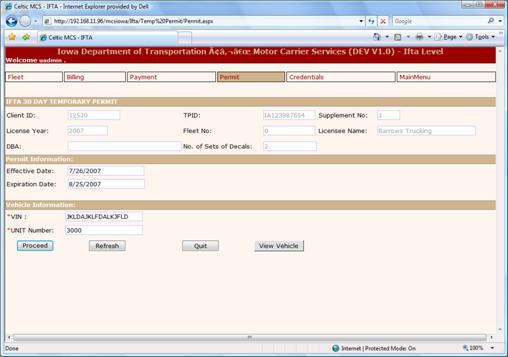

If the user has requested 30 day permits after selecting

“proceed” from the payment validation screen, the Permit screen will be displayed.

For any given

supplement, the number of temporary decals issued should be equal to or less

than the number of sets of decals requested on the supplement. The decals will

be issued after the information is added for all the vehicles.

From this screen the user has the following

options:

·

Proceed – user must provide the required

information and proceed to the validation screen

·

View Vehicle – selecting this will provide the

user will a list of the vehicle that have been previously entered for permits

o Once

the list of vehicles has been provided, the “Hide Vehicle” option will be provided which

will remove the list from the screen

·

Refresh – refreshes the screen to the original

default values

·

Quit – return to the IFTA menu – does not cancel

the transaction

The effective

date is defaulted to the current date and the expiration is defaulted to 30

calendar days from the effective date.

The user must

provide the following vehicle information which is printed on the temporary

decal:

·

VIN - a

warning will be provided is the VIN is less than 17 characters

·

Unit number

Once the user

enters the required information, selecting “proceed” will display the

validation screen. This screen has the

following options:

·

Proceed. Selecting proceed will save the vehicle

information to produce the temporary authority. The system will only provide

one temporary for each set of decals requested.. If the user has not reached the maximum

number of set of decals for the supplement, the “proceed” button will return to

the permit screen to add information for additional temporary decals.

·

Back. Redisplays the previous page so that

errors may be corrected.

·

Process for Credentials. If as user requested 5

sets of decals but only wants temporaries for 3 vehicles they can select the

“Process for Credentials” button at any time to stop generating temporaries and

produce the temporaries and shipping document required for the supplement.

Once all the

information is added for all the temporary decal, the decals will be provided

with the other credentials for the supplement. The temporary permit is an 8 ½ x

11 providing one vehicle per page with the following information:

·

Carrier name

·

Address

·

Vehicle information – unit number and VIN

·

IFTA fleet number

·

Issue Date

·

Expiration Date – calculated as thirty days from

the issue date

·

Signature

Decals will be

issued after full payment has been received for the supplement. Inventory files will be updated to reflect the

decals issued. The supplement record will

be updated to record the beginning and ending decal number. The inventory file will reflect each decal

issued to the carrier. Decals are

preprinted with the inventory number and are year specific.

A shipping

record will always be printed for each supplement that issues decals. The

shipping document will provide the inventory clerk, the ranges of decals to

pull from inventory. The shipping record will provide the following

information:

- Client ID

- Carrier name

- DBA if provided

- Shipping address if provided, if not then mailing, if

not then place of business address will be printed

- Number of set of decals issued

- Year of decals issued

- Range of set of decals issued

The IFTA license

will print on an 8 ½ x 11 piece of paper.

The following carrier information will print on the license:

- Client ID

- Licensee Name

- DBA if one exists

- Place of Business Address

- IFTA license number including base jurisdiction

abbreviation and Tax ID number

- License expiration date

- License year

IFTA licenses

must be renewed annually and are valid for the calendar year January 1 through

December 31. Renewal Notices and decal

applications are sent to active carriers with the tax return forms for the 3rd

quarter during the month of September.

All supplements

from the previous year must be “Closed” for the renewal to be processed. This will make certain that any name change

supplements are resolved before the renewal process begins, ensuring the

carrier is charged for the name change.

Suspended and

closed carriers cannot renew and should go through the reinstatement process. This will ensure that all fees are charged

correctly.

The following

options are available for printing the renewal notices:

·

From the IFTA main menu select “Admin – generate

renewal notice”

o View.

Displays a blank form for use by a carrier

o Print.

Creates all the renewal forms for a given year. This is a large job and should

not be done during business hours.

·

From the IFTA main menu select “Reprint –

renewal notice”

o Provide

the Client ID

o Provide

the renewal year

o A

form will be displayed for the client id and year specified.

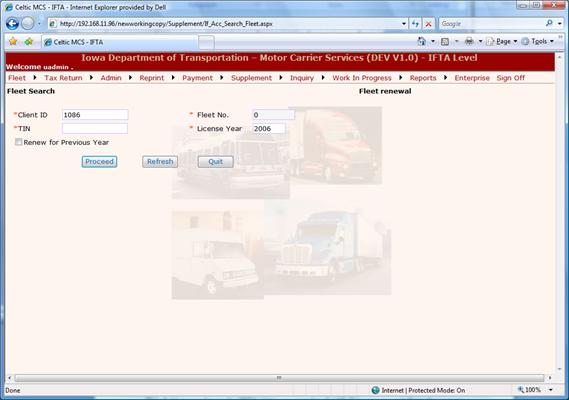

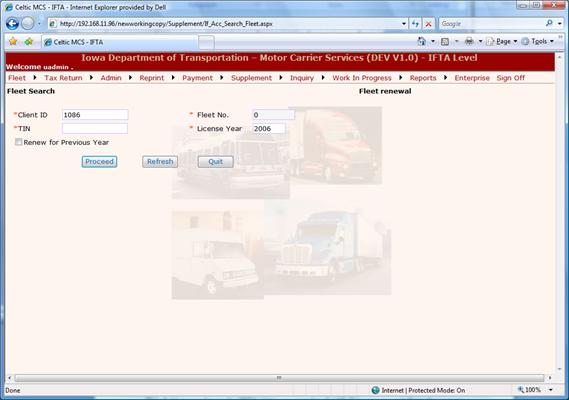

The renewal

transaction is initiated by doing the following steps:

·

Select

“Supplement – Renew Fleet” from the IFTA menu

·

Enter either

the client id or TIN

·

Enter the

license year. The license year is the

year that is being renewed. So if you

are renewing for 2007, the license year being renewed is 2006.

·

Select

“proceed” to continue to the fleet screen.

The current

IFTA fleet information will be populated with the existing values from the

previous year except for the TIN, business name and place of business which

will be populated from current value from Enterprise

client. If changes are required for

these fields, the user should change them by updating the Enterprise

client information using the “Client – update” menu item on the Enterprise level menu.

4.2.1.1

Licensee Name

This is the

carrier’s business name and it pre-populated from the Enterprise Client business

name and cannot be changed. If the name

needs to be change, the user must change the name on the Enterprise client.

4.2.1.2

TPID

The TPID is the carrier’s FEIN/SSN and is pre-populated from

the Enterprise Client value. If the TPID

needs to be change, the user must change it on the Enterprise client.

4.2.1.3

Doing Business As

The DBA will be pre-populated from the existing IFTA

fleet information and may be changed as necessary

4.2.1.4

Business Contact Name

This field is

mandatory for IFTA and is pre-populated with the contact name from the current

IFTA information. The user may change

the contact name to the specified contact name for the IFTA fleet.

4.2.1.5

Fleet Effective Date

IFTA licenses

must be renewed annually and are normally valid for the calendar year January 1

through December 31. For a new fleet,

the fleet effective date will default to today’s date and the user may change

as necessary

4.2.1.6

Fleet Expiration Date

IFTA licenses must be renewed

annually and will expire on December 31 for any given year. This date will default to December 31 of the

current year. As the fleet effective

year changes, the fleet expiration year will be set to match the effective date

year.

4.2.1.7

Fleet Status

The current

fleet status cannot be changed by the user.

4.2.1.8

Phone Number

This field is

mandatory and is the contact’s phone number. This field is pre-populated with

the contact phone number from the current IFTA information.

4.2.1.9

Fax Number

This field is

not mandatory and is the fax number for the IFTA Fleet. This field is pre-populated with the fax number

from the current IFTA information. This

fax number is used as the default fax number when fax is selected for

correspondence and credentials.

4.2.1.10 Electronic

Filer

Electronic Filer

is a checked box used to designate that a carrier would like to receive renewals

and tax return reminders electronically. This field is pre-populated from the

current IFTA information. If this boxed is checked, the email address is

required.

4.2.1.11 Email

Address

The email address for the contact person or company address

as requested by the carrier. This field is pre-populated from the current IFTA

information. This will be used for

emailing various documents and notifications.

4.2.1.12 Fleet

Addresses

The IFTA fleet can have up to four different

addresses. The place of business address

cannot be changed. The mailing address

can be modified to a specific mailing address for the IFTA fleet. In addition to the mailing address, each

fleet can have an optional decal shipping address and Location of Records

address.

4.2.1.13

Operation Information

4.2.1.13.1

Fuel Types

The carrier must indicate all the fuel types for each fleet by

checking the appropriate check box beside the fuel type. At least one fuel type

must be checked.

4.2.1.13.2

Number of IFTA Decal Sets

The user must provide the number

of set of decals the carrier will be invoiced for. Renewed carriers must have at least one set

of decals issued to them.

4.2.1.14 Reporting

Service

The MCS system

will provide a listing of valid reporting service companies and an associated

client id. This information is entered on the Enterprise Client and will be

pre-populated from the Client level. The

user can change the reporting service and make it specific for the IFTA fleet.

To adding or

update reporting service information, the user clicks on the Reporting Service

Tab. The Reporting Service information is displayed including:

·

Name

·

Business Address

·

Phone Number

·

Fax Number

·

Email Address

A Power of

attorney document is required if the carrier is using someone other than an

officer or employee of the company to file quarterly tax returns. Once the Power of Attorney is provided by the

carrier, the user can click on the check box to indicate it has been received.

If the power of

attorney check box has not been checked and there is a reporting service, the

supplement transaction cannot continue.

4.2.1.15 Fleet

Comments

The internal user can add

any comments associated with the IFTA fleet.

WEB users cannot add or view comments.

Once the user has completed updating the fleet

information, the user selects “proceed” to proceed to the fleet validation screen. If the information is correct, selecting

“proceed” will display the billing screen.

If the information is incorrect, selecting “back” will go back to the

fleet screen and the user can update the information in error.

The IFTA supplements do not require the creation of an

invoice. Once the billing screen is

displayed the user has the ability to perform the following functions:

·

Fleet tab (top of screen) – goes back to the

Fleet screen and allows user to update the information when the supplement

status is “Open”

·

Override fees by checking the “Waive” check

boxes

·

Quit – exit the transaction to continue later

·

Cancel – cancel the transaction removing the

supplement

·

Proceed – when supplement is in “open” status

the supplement status will become invoice and will proceed to the payment

initialization screen.

·

Cancel billing – if the supplement is invoice

the “Cancel” button becomes “Cancel Billing” and allows the user to cancel the

invoice.

The following information is in the fee information portion

of the screen:

License Fee – the

amount of the license - can be overridden (checkbox) – license fee is charged

if the carrier’s name, either business or DBA has changed. For 2008 renewal, the license fee will not be

charged - WEB users cannot override any fees

Decal Fee – the

amount of the decals – can be overridden (checkbox) - WEB users cannot override

any fees

Shipping Fee – no

shipping fees are currently charged. If

the user overrides this they can enter an amount for the shipping fees. - WEB

users cannot override any fees

See Section 3.3.

Once a

supplement has been paid for, the credentials for the given supplement type can

be issued. For a renew fleet, the

credentials issued include the IFTA license and decals

Once the

credentials are issued, the supplement status should be updated to “C” for

Completed. The fleet information will be

reported to the Clearinghouse and detailed on the reports going to

non-Clearinghouse jurisdictions.

4.2.4.1

Issue Decals

Decals will be

issued after full payment has been received for the supplement. Inventory files will be updated to reflect

the decals issued. The supplement record

will be updated to record the beginning and ending decal number. The inventory file will reflect each decal issued

to the carrier. Decals are preprinted

with the inventory number and are year specific.

4.2.4.2

Shipping Document

A shipping

record will always be printed for each supplement that issues decals. The

shipping document will provide the inventory clerk, the ranges of decals to

pull from inventory. The shipping record will provide the following

information:

- Client ID

- Carrier name

- DBA if provided

- Shipping address if provided, if not then mailing, if

not then place of business address will be printed

- Number of set of decals issued

- Year of decals issued

- Range(s) of set of decals issued

4.2.4.3

IFTA License

The IFTA license

will be provided either by email, fax or printed and shipped to the carrier

with decals as required. The format for

the license is provided in Appendix A. The IFTA license will print on an 8 ½ x

11 piece of paper. The following carrier

information will print on the license:

- Client ID

- Licensee Name

- DBA if one exists

- Place of Business Address

- IFTA license number including base jurisdiction

abbreviation and Tax ID number

- License expiration date

- License year

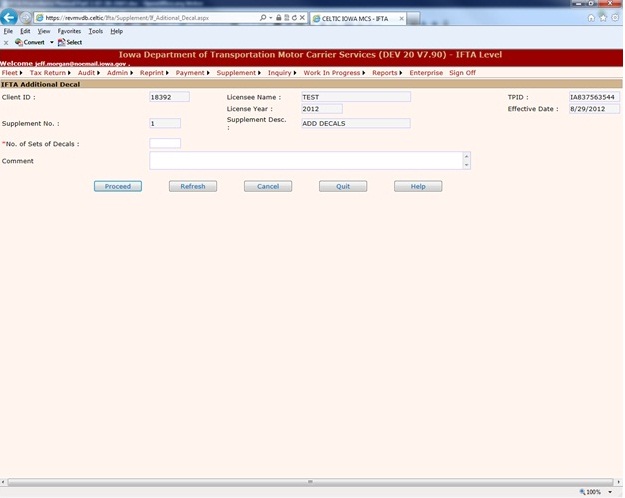

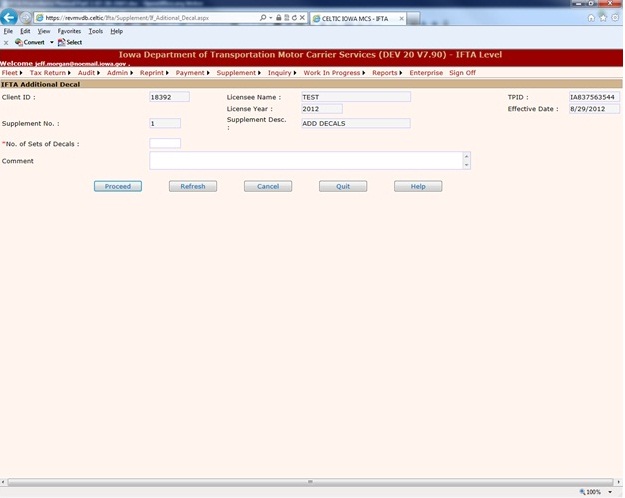

The Additional Decal

supplement allows the user to issue additional decals to a specific fleet, and

license year. The IFTA fleet status must

be Active. The use will select the “Add

Decals” supplement from the IFTA main menu and enter either the Client ID or

the Tax Id Number, the License year and

select the Proceed button and the IFTA Additional Decals screen will be

displayed.

·

The user will verify the licensee name and TPID

selected to make sure it is the correct customer.

·

The user will specify the number of decal set

requested. A minimum of one set of

decals is required.

·

A comment may be added by the user. Comments

cannot be added or viewed by the WEB users.

Once the

information has been provided, the user should select “proceed” to display the

verification screen. From the

verification screen, the user can select “Proceed” to display the billing

screen or select the “Back” button to change the number of sets of decals.

The IFTA supplements do not require the creation of an

invoice. Once the billing screen is

displayed the user has the ability to perform the following functions:

·

Fleet tab (top of screen) – goes back to the

previous screen and allows user to

update the information when the supplement status is “Open”

·

Override fees by checking the “Waive” check

boxes

·

Quit – exit the transaction to continue later

·

Cancel – cancel the transaction removing the

supplement

·

Proceed – when supplement is in “open” status

the supplement status will become invoice and will proceed to the payment

initialization screen.

·

Cancel billing – if the supplement is invoice

the “Cancel” button becomes “Cancel Billing” and allows the user to cancel the

invoice.

·

Request 30 day temporary authorities - by checking the check box labeled 30 day

temporary

The following information is in the fee information portion

of the screen:

·

Decal Fee – the amount of the decals – can be

overridden (checkbox) - WEB users cannot override any fees

·

Shipping Fee – no shipping fees are currently

charged. If the user overrides this they

can enter an amount for the shipping fees - WEB users cannot override any fees

5.1.1

Payment

See Section 3.3.

Once a

supplement has been paid for, the credentials for the given supplement type can

be issued. For an additional decal

supplement, the credentials issued include decals and temporary authorities if

requested.

Once the

credentials are issued, the supplement status should be updated to “C” for

Completed. The fleet information will be

reported to the Clearinghouse and detailed on the reports going to

non-Clearinghouse jurisdictions.

·

See Section 3.4.1.

Decals will be

issued after full payment has been received for the supplement. Inventory files will be updated to reflect

the decals issued. The supplement record

will be updated to record the beginning and ending decal number. The inventory file will reflect each decal

issued to the carrier. Decals are preprinted

with the inventory number and are year specific.

A shipping

record will always be printed for each supplement that issues decals. The

shipping document will provide the inventory clerk, the ranges of decals to

pull from inventory. The shipping record will provide the following

information:

- Client ID

- Carrier name

- DBA if provided

- Shipping address if provided, if not then mailing, if

not then place of business address will be printed

- Number of set of decals issued

- Year of decals issued

- Range(s) of set of decals issued

Throughout the

year the carrier may need to change IFTA fleet information and receive a new

license. The changes may include carrier

name, DBA, addresses, and fuel types. As

a result of this supplement a new license will be issued.

If the

information changed is the carrier’s TPID (FEIN/SSN), licensee (business) name,

or physical address this transaction must be initiated by changing the Enterprise client

information. As a result of Enterprise client change,

a change fleet supplement will be automatically created on the IFTA fleet. The user should use the “work in progress –

supplement” process to complete the IFTA supplement. Following is the steps to follow:

·

Update the Enterprise Client using “Client –

Update” menu option on the Enterprise Menu

·

Open the create IFTA supplement using “Work in

Progress – Search Supplement” menu option from the IFTA menu

·

Complete the open supplement

o If

additional fleet information needs to be changed like mailing address, select

the fleet tab at the top of the screen.

This will also allow you to review the updated Enterprise client information on the fleet

screen.

o Proceed

through billing and payment screens for the supplement

This supplement

can also be used outside of completing the changes initiated from the Enterprise client. For example, if only the carrier’s DBA name

needed to be changed, the user would select the change fleet supplement from

the IFTA menu. The user would be able to

update any fleet information for the carrier with this supplement. To initiate this transaction, the user would

select the supplement and provide the client id or TPID and appropriate year

for the supplement.

It is important

to note that a change fleet supplement only needs to be performed when a

license is required. To change items

such as mailing addresses, shipping address, reporting service and fuel types,

the fleet maintenance business function can be used.

The licensee

name, place of business address and TPID are provided from the Enterprise client records

and the rest of the information on the fleet screen is populated from the

current IFTA fleet information.

6.1.1.1

Licensee Name

This is the

carrier’s business name and it pre-populated from the Enterprise Client

business name and cannot be changed. If

the name needs to be change, the user must change the name on the Enterprise client.

6.1.1.2

TPID

The TPID is the carrier’s FEIN/SSN and is pre-populated from

the Enterprise Client value. If the TPID

needs to be change, the user must change it on the Enterprise client.

6.1.1.3

Doing Business As

The DBA will be pre-populated from the existing IFTA

fleet information and may be changed as necessary

6.1.1.4

Business Contact Name

This field is

mandatory for IFTA and is pre-populated with the contact name from the current

IFTA information. The user may change

the contact name to the specified contact name for the IFTA fleet.

6.1.1.5

Fleet Effective Date

IFTA licenses

must be renewed annually and are normally valid for the calendar year January 1

through December 31. For a new fleet,

the fleet effective date will default to today’s date and the user may change

as necessary

6.1.1.6

Fleet Expiration Date

IFTA licenses must be renewed

annually and will expire on December 31 for any given year. This date will default to December 31 of the

current year. As the fleet effective

year changes, the fleet expiration year will be set to match the effective date

year.

6.1.1.7

Fleet Status

The current

fleet status cannot be changed by the user.

6.1.1.8

Phone Number

This field is

mandatory and is the contact’s phone number. This field is pre-populated with

the contact phone number from the current IFTA information.

6.1.1.9

Fax Number

This field is

not mandatory and is the fax number for the IFTA Fleet. This field is pre-populated with the fax

number from the current IFTA information.

This fax number is used as the default fax number when fax is selected

for correspondence and credentials.

6.1.1.10 Electronic

Filer

Electronic Filer

is a checked box used to designate that a carrier would like to receive

renewals and tax return reminders electronically. This field is pre-populated

from the current IFTA information. If this boxed is checked, the email address

is required.

6.1.1.11 Email

Address

The email address for the contact person or company address

as requested by the carrier. This field is pre-populated from the current IFTA

information. This will be used for

emailing various documents and notifications.

6.1.1.12 Fleet

Addresses

The IFTA fleet can have up to four different

addresses. The place of business address

cannot be changed. The mailing address

can be modified to a specific mailing address for the IFTA fleet. In addition to the mailing address, each

fleet can have an optional decal shipping address and Location of Records

address.

6.1.1.13 Operation

Information

6.1.1.13.1

Fuel Types

The carrier must indicate all the fuel types for each fleet

by checking the appropriate check box beside the fuel type. At least one fuel

type must be checked.

6.1.1.13.2

Number of IFTA Decal Sets

Decals are not issued for this

supplement.

6.1.1.14 Reporting

Service

The MCS system

will provide a listing of valid reporting service companies and an associated

client id. This information is entered on the Enterprise Client and will be

pre-populated from the Client level. The

user can change the reporting service and make it specific for the IFTA fleet.

To adding or

update reporting service information, the user clicks on the Reporting Service

Tab. The Reporting Service information is displayed including:

·

Name

·

Business Address

·

Phone Number

·

Fax Number

·

Email Address

A Power of

attorney document is required if the carrier is using someone other than an

officer or employee of the company to file quarterly tax returns. Once the Power of Attorney is provided by the

carrier, the user can click on the check box to indicate it has been received.

If the power of

attorney check box has not been checked and there is a reporting service, the

supplement transaction cannot continue.

6.1.1.15 Fleet

Comments

The internal user can add

any comments associated with the IFTA fleet.

WEB users cannot add or view comments.

Once the user has completed updating the fleet

information, the user selects “proceed” to proceed to the fleet validation

screen. If the information is correct,

selecting “proceed” will display the billing screen. If the information is incorrect, selecting

“back” will go back to the fleet screen and the user can update the information

in error.

The IFTA supplements do not require

the creation of an invoice. Once the

billing screen is displayed the user has the ability to perform the following

functions:

·

Fleet tab (top of screen) – goes back to the

Fleet screen and allows user to update the information when the supplement

status is “Open”

·

Override fees by checking the “Waive” check

boxes

·

Quit – exit the transaction to continue later

·

Cancel – cancel the transaction removing the

supplement

·

Proceed – when supplement is in “open” status

the supplement status will become invoice and will proceed to the payment

initialization screen.

·

Cancel billing – if the supplement is invoice

the “Cancel” button becomes “Cancel Billing” and allows the user to cancel the

invoice.

The following

information is in the fee information portion of the screen:

License Fee – the amount of the license -

can be overridden (checkbox) – license fee is charged if the carrier’s name,

either business or DBA has changed.

See Section 3.3.

Once a

supplement has been paid for, the credentials for the given supplement type can

be issued. For a change fleet, the

credentials issued include the IFTA license.

Once the

credentials are issued, the supplement status should be updated to “C” for

Completed. The fleet information will be

reported to the Clearinghouse and detailed on the reports going to

non-Clearinghouse jurisdictions.

The IFTA license

will be provided either by email, fax or printed and shipped to the carrier

with decals as required. The format for

the license is provided in Appendix A. The IFTA license will print on an 8 ½ x

11 piece of paper. The following carrier

information will print on the license:

- Client ID

- Licensee Name

- DBA if one exists

- Place of Business Address

- IFTA license number including base jurisdiction

abbreviation and Tax ID number

- License expiration date

- License year